Bond yield to maturity formula

Our funds have star power. B par value.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

What is the yield to maturity formula.

. The formula for the approximate yield to maturity on a bond is. Ad Explore funds and choose those that align with your clients goals. C annual coupon payment in dollars not a percent Y number of years to maturity.

To calculate the current yield the formula consists of dividing the annual coupon payment by the current market price. Yield to Maturity. Current Yield Annual Coupon Bond Price Calculating the current yield.

The formula for Bond Yield can be calculated by using the following steps. The annualized yield to maturity YTM. In the above table that represents a yield to maturity example we see that the YTM of 541 for the fund when calculated using its face value increased to a maximum of 689 and fell to a.

Firstly determine the bonds par value be received at maturity and then determine coupon payments. Heres an example of how to use the YTM formula. Now for the final step we must convert our semi-annual YTM to an annual percentage rate ie.

The yield to maturity formula looks at the effective yield of a bond based on. INR 950 401YTM1 401YTM2 401YTM3 10001YTM3. The yield to maturity formula is used to calculate the yield on a bond based on its current price on the market.

In the case of a Bond YTM is defined as the total rate of return that a Bond Holder expects to earn if a Bond is held till maturity. The YTM formula for a single Bond is. The expected yield to maturity is 79 annually.

Assume you want to buy a zero-coupon bond and want to evaluate what YTM of this bond would be. Annual Yield to Maturity YTM 27 2 54. A number of funds have earned 4- and 5-star ratings.

YTM C FPn FP2 where. The formula for calculating the yield to maturity on a zero-coupon. Yield to Maturity is calculated using the formula given below.

Yield to maturity is the total return an investor anticipates receiving from holding a bond until full maturity. Calculate the yield to maturity of a bond with the help of the following given information. Using the YTM formula the required yield to maturity can be determined.

C Couponinterest payment F Face. C 1 r -1 c 1 r -2. A bonds yield to maturity YTM is the internal rate of return required for the present value of all the future cash flows of the bond face value and coupon payments.

The most common formula used to calculate yield to maturity is. Annual Interest Payment Face Value - Current Price Years to Maturity Face Value Current Price 2. C 1 r -Y B 1 r -Y P.

Suppose theres a bond with a market price of 800 a face value of 1000 and a coupon value of 150.

Calculate The Ytm Of A Coupon Bond Youtube

Yield To Maturity Fixed Income

Yield To Maturity Ytm Formula And Calculator Excel Template

Yield To Maturity Approximate Formula With Calculator

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

How Can I Calculate The Present Value Of A Bond Using Ytm Economics Stack Exchange

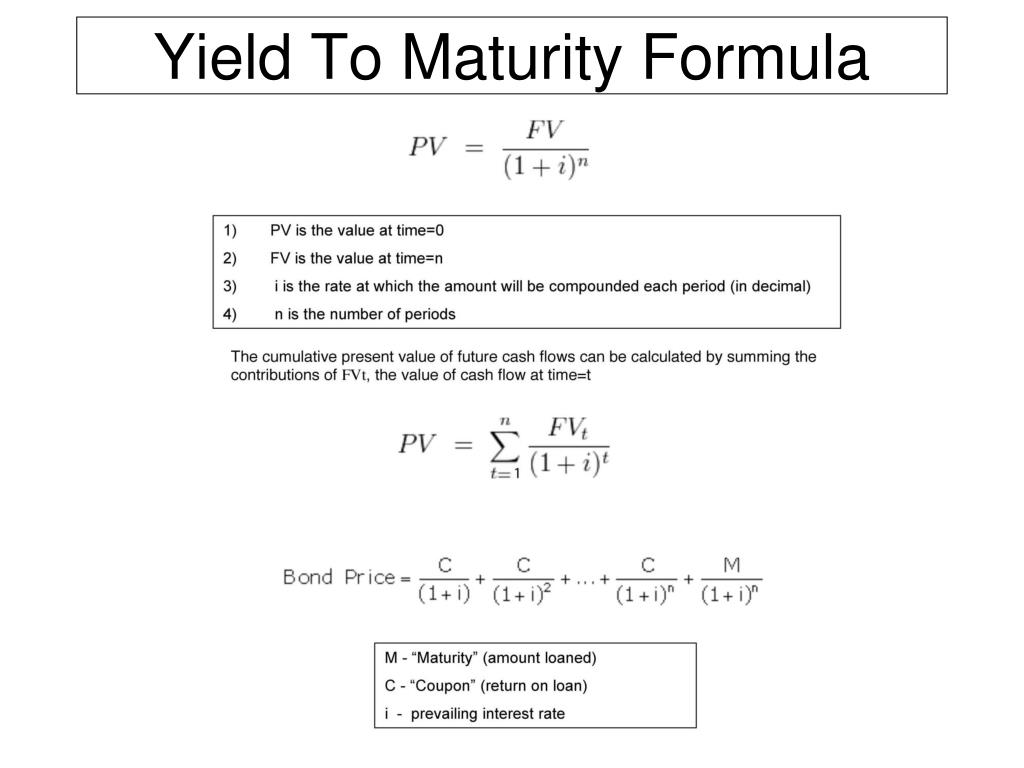

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id 5774476

Yield To Maturity Ytm Formula And Calculator Excel Template

Bond Yield Calculator

Yield To Maturity Ytm Formula And Calculator Excel Template

Yield To Maturity Formula Examples How To Calculate Ytm Video Lesson Transcript Study Com

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

Yield To Maturity Ytm Meaning Formula Calculation

Yield To Maturity Ytm Approximation Formula Finance Train

Zero Coupon Bond Formula And Calculator Excel Template

Yield To Maturity Ytm Approximation Formula Finance Train

Bond Yield Calculator